south dakota property tax abatement

South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. South Dakota Codified Laws 10-18.

Property Tax South Dakota Department Of Revenue

2010 South Dakota Code Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds.

. Public Utilities Commission Capitol Building 1st floor 500 E. A County Auditor needs to know the Taxable Value of the taxing entity from the growth form and its current Tax Requested. South Dakota Department of Revenue.

South Dakota Codified Laws 10-14. 18A Property Tax Refund For Elderly And Disabled Persons. Request Value Tax Rate.

Thus even if home values increase by 10 property taxes will increase by no more than 3. Based On Circumstances You May Already Qualify For Tax Relief. A proposal to alter the text of a pending bill or other measure by striking.

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate. CHAPTER 10-18 PROPERTY TAX ABATEMENT AND REFUNDS 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. Section 10-18-2 - Compromise abatement or rebate of uncollectible tax-Circumstances in which authorized.

1 COUNTY AUDITOR OFFICE Print. Ad See If You Qualify For IRS Fresh Start Program. Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds.

Abatement of nuisance--Notice required--Taxing cost of abatement--Civil action. 19 Lien Of Property Tax Repealed. A public nuisance may be abated without civil action by any public body or officer as authorized by law.

2014 South Dakota Codified Laws Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for. However five-year property tax.

Section 10-18-1 - Invalid or erroneous assessment or tax--Claims for abatement or refund-. Wind solar biomass hydrogen hydroelectric. 10-18-11 Time allowed for abatement or refund of invalid inequitable or unjust tax.

Please submit your request to the Department of Revenue Special Tax Division 445 East Capitol Avenue Pierre SD 57501-3185. South dakota property tax abatement Friday March 4 2022 Edit. Applications are accepted from May 1 to July 1.

Section 10-18-1 - Invalid or erroneous assessment or tax--Claims for abatement or. 2020 South Dakota Codified Laws Title 10 - Taxation Chapter 18 - Property Tax Abatement And Refunds. Pierre SD 57501-5070 Phone.

2012 South Dakota Codified Laws Title 10 TAXATION Chapter 18. Pay Property Taxes Online. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in.

Free Case Review Begin Online. 18 Property Tax Abatement And Refunds. The forms are also available to download through the South Dakota State website.

10-18-2 Compromise abatement or rebate of uncollectible tax--Circumstances in which authorized-. Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent. Chapter 18 - Property Tax Abatement And Refunds.

2011 South Dakota Code Title 10 TAXATION Chapter 18. PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers. Email the Treasurers Office.

Property Tax South Dakota Department Of Revenue

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/MUTCLK5D7JGCTIDI6PJRO3E22I.jpg)

Deadline Approaching For Elderly Disabled South Dakotans To Apply For Property Tax Relief

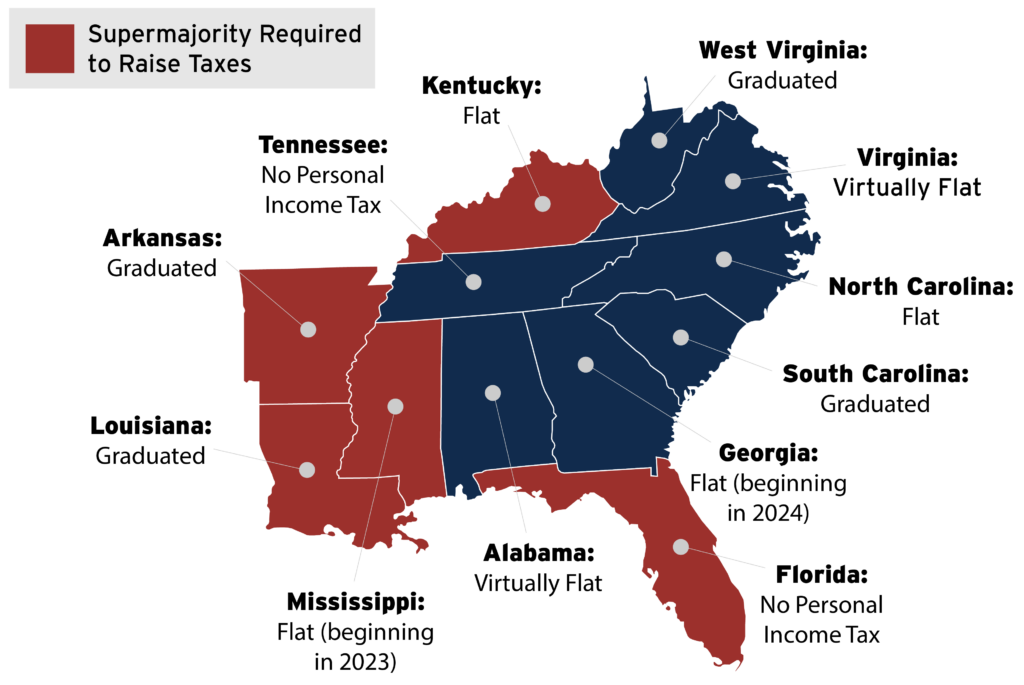

Creating Racially And Economically Equitable Tax Policy In The South Itep

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

South Dakota Estate Tax Everything You Need To Know Smartasset

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

South Dakota Property Tax Calculator Smartasset

Wyoming Quit Claim Deed Form Quites The Deed Wyoming

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Illinois Quit Claim Deed Form Quites Illinois The Deed

South Dakota Estate Tax Everything You Need To Know Smartasset